Medicare Supplement Plans

Enhance Your Coverage with Medicare Supplement Plans

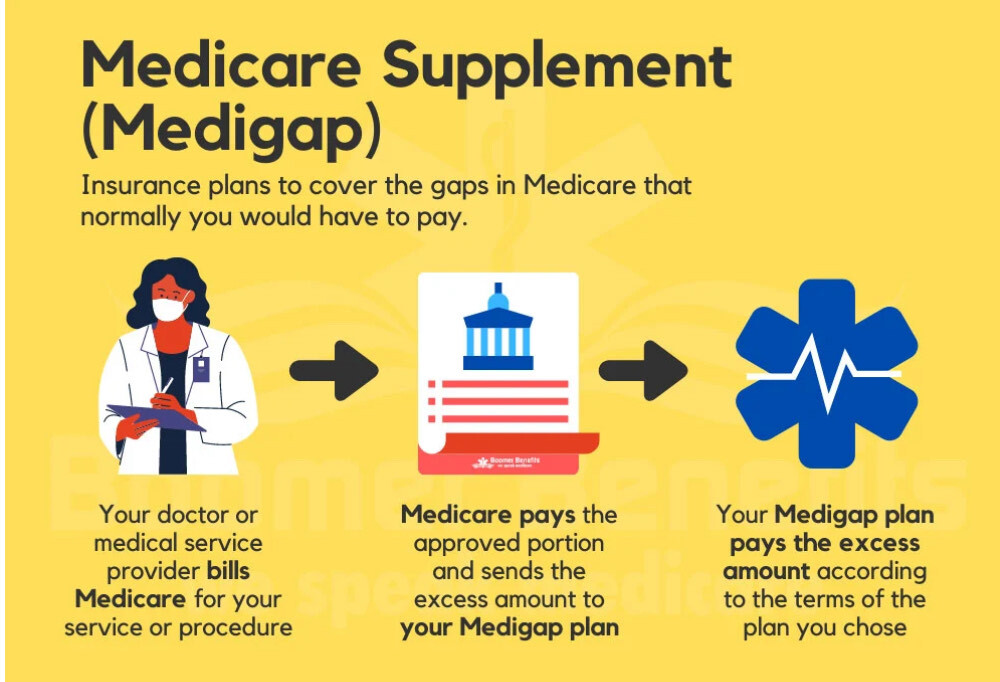

At Eutaw Life and Health, our Medicare Supplement Plans are designed to fill the gaps in Original Medicare, providing you with additional financial protection and peace of mind. These plans help cover out-of-pocket costs such as copayments, coinsurance, and deductibles, ensuring you won’t be burdened by unexpected expenses. With a range of plans to choose from, you can select the coverage that best fits your healthcare needs and budget. Our Medicare Supplement Plans offer the flexibility to visit any doctor or hospital that accepts Medicare, giving you freedom and choice in your healthcare journey. Our dedicated team is here to guide you through the enrollment process, helping you understand your options and choose the right plan to enhance your Medicare coverage. Your health is our priority.

Why Consider Medicare Supplement Plans?

Medicare Supplement Plans, also known as Medigap, provide essential financial support for those enrolled in Original Medicare. One of the primary reasons to consider these plans is their ability to cover out-of-pocket costs that can quickly add up, such as deductibles and coinsurance. This additional coverage helps you manage healthcare expenses more effectively, allowing you to focus on your health. Moreover, Medigap plans offer the freedom to choose any doctor or hospital that accepts Medicare, ensuring you receive the care you need without being restricted to a network. Many plans also include benefits for foreign travel emergencies, giving you peace of mind while traveling.

At Eutaw Life and Health, our knowledgeable team can help you explore the different Medicare Supplement options available, ensuring you select a plan that aligns with your healthcare needs and financial goals. Your well-being is our mission.

How to Choose the Right Medicare Supplement Plan

Selecting the right Medicare Supplement Plan requires careful consideration of your healthcare needs and financial situation. Start by evaluating your current medical expenses, including regular doctor visits and any ongoing treatments. This will help you identify which out-of-pocket costs you want to cover. Next, review the different Medigap plans available in your area, as each offers varying levels of coverage. Compare premiums and benefits to find a plan that fits your budget while providing the necessary protection. It’s also crucial to understand the enrollment periods, as signing up during your initial enrollment window ensures guaranteed acceptance without medical underwriting. At Eutaw Life and Health, our experienced team is ready to assist you in navigating your options and selecting the best Medicare Supplement Plan tailored to your needs. Your health is our priority.